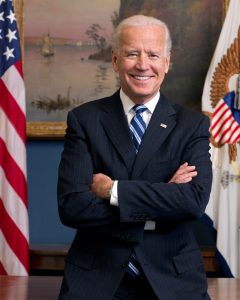

03 May How will Biden tax increases affect multifamily investors?

Are you searching for more information on how the Biden Administrations’ tax increases will affect multifamily investors? If so, you’ve come to the right place!

This is a topic that’s been on the mind of most investors in 2021 as everyone knows that it’s going to take revenue to pay for the ambitious agenda that the Biden Administration has.

In this article, we will break down how some of the Biden Tax Increases will affect investors in 2021 and beyond.

1031 Exchanges

Biden’s team has stated since he started campaigning that one of their goals was to change 1031 exchanges, and they finally appear close to meeting this goal.

The changes that they propose would mean disallowing the use of 1031 exchanges for transactions that are more than $500,000.

What does this mean for investors?

Once implemented, an investor who previously purchased a property for $5 million, and wants to sell it for $15 million, would no longer be able to invest that $15 million. They would have to pay roughly 90% of the proceeds from the sale of that property to Federal and Capital Gains taxes.

How will this affect the multifamily market?

Expect more investors to rush to sell properties before changes to the 1031 exchange are implemented and once those changes go into effect, we can expect to see less liquidity in the multifamily market.

Capital Gains Tax Increases

Besides changing the 1031 exchange, we can also expect the Biden Administration to raise the tax rate on capital gains for investors making over $1 million per year. This would affect up to 40% of millionaires in the United States and it would also adversely affect investors in California, where the cost of living has risen exponentially in the last 5 years and $1 million per year in California is not what it once was.

How will capital gains increases affect investors?

Combining the changes to the 1031 exchange along with changes to capital gains is being seen as a ‘double-edged sword’ to investors, especially those that have been struggling during the pandemic and eviction moratorium.

These changes will likely decrease multifamily investor activity in Los Angeles, at least for the foreseeable future, as investors work to restructure their businesses and adapt to changes during the Biden Economy.

Contact MW Real Estate Group

For more information on the multifamily real estate market, or to speak with us about our property management services, contact us today by calling (213) 924-2117 or click here to connect with us online.