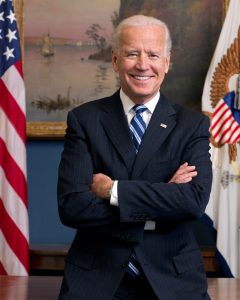

20 Nov How Will Real Estate Investing Change Under The Biden Administration?

The November 2020 election has been over for three weeks now and with a new year around the corner, most investors have been asking how will real estate investing change under the Biden Administration?

In this article, we will answer this question and provide you with insight into what the future could hold for real estate investors during the next presidency.

1031 Exchanges

There’s no denying that 1031 exchanges have been beneficial for real estate investors because a real estate investor can forgo having to pay capital gains on a property when they sell it by investing money from the property that they sold into another “like-kind” property.

Under the Biden Administration, they would limit the use of 1031 exchanges to investors who earn less than $400,000 annually.

When word spread of Biden’s plan to change 1031 exchanges, feedback from investors has been mostly negative.

New York real estate developer, Francis Greenburger said that Biden’s changes to 1031 exchanges could affect two-thirds of real estate investments nationwide.

Opportunity Zones

Another beneficial program during the Trump Administration has been Opportunity Zones. This program has pumped hundreds of millions of dollars into economically distressed communities across the United States.

With Opportunity Zones, investors can defer paying capital gains on other properties when they invest in opportunity zones.

Although he didn’t say that he wanted to ‘eliminate Opportunity Zones’, Biden did say that he wanted to ‘reform’ the program and this means that investors could see major changes to this program during the Biden Administration.

Taxes

And now to the big T word, taxes, a common topic of conversation among real estate investors.

As of November 2020, we know that Biden wants to raise the top tax rate from 37% to 39.6%, per year. This change to the tax code would affect investors who earn $520,000 per year and investors who earn more than $620,000 per year.

When Will These Changes Occur?

If you follow the news, you know that unless something is done for renters and homeowners, we face an eviction and foreclosure crisis in the coming months.

Besides dealing with these two problems, Biden’s Administration also has to coordinate the release of a Coronavirus vaccine and do what’s needed to continue the economic recovery.

Most investors analysts agree that the changes mentioned in this article may not occur for at least two years, if at all because they could exacerbate the economic crisis in the United States.

When you look at how the Stock Market has been performing in recent weeks, it’s clear that stock investors are unfazed by the thought of a Biden presidency.

Ultimately, only time will tell when the Biden Administration rolls out these changes which will affect real estate investors.

If you’re thinking about buying or selling property now, it would be a good time to make your move before the end of the year.

Contact MW Real Estate Group

At MW Real Estate Group, we provide ‘boutique-style’ property management to all of our clients. This means that we treat each client like they are our only client.

For professional property management service, contact us today by calling (213) 927-2117 or click here to connect with us online.